In West Virginia, all drivers must carry a minimum level of auto insurance coverage of $25,000 for both liability and property damage. However, many people fail to carry this level of insurance, and some fail to carry any insurance at all. If you get into a car accident with an uninsured or underinsured driver on the state’s roads, you may need to have your own insurance provider cover your damages, but they can only do that if you carry uninsured/underinsured motorist coverage. While this type of coverage is not mandatory, it is worth the additional expense in the event you’re injured in an accident caused by a motorist with no insurance or not enough.

If you have an auto accident in West Virginia with an uninsured driver, you may not be able to sue the other driver for compensatory damages. However, West Virginia requires insured motorists to have uninsured coverage. The law caps the amount of this coverage for bodily injury, and your insurance company will probably try to minimize the amount of the settlement. You will need to provide documentation to back up your claim.

Be Wary of Independent Settlements

Be wary if the uninsured driver offers to settle with you independently. If you can show that the uninsured driver was at fault for the accident, you can also bring a civil suit to recover the costs of damages and injury.

Your auto insurance policy outlines procedures for paying to repair or replace your vehicle after an auto accident in West Virginia. Most collision policies pay for damages, minus your deductible. If the other driver is responsible for the accident (at-fault), their insurance company is responsible for covering the damages to your car.

Your uninsured coverage allows you to recoup some of your property damage expenses through your own insurer if the at-fault party is not covered or in the event of a hit-and-run accident. After you come to an agreement on a claim for physical injury or damage to your automobile, your insurance company should reimburse you for these expenses in a timely manner. They may decide to recover the amount they payout from the at-fault driver if liability can be proved.

You need a highly qualified automobile accident attorney in West Virginia

A car accident can happen in seconds. Resolving all the consequences of an accident, especially financial compensation for injury and damages, is a complicated process. If you have an auto accident or suffered a personal injury in West Virginia, do not assume that your personal injury and property damage expenses will be covered by automobile insurance.

Besides a determination of liability and fault, a claim for damages after an auto accident can involve questions that are not easy to resolve, which is why many claims end up in court.

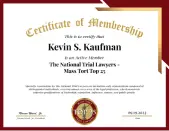

If you were in an auto accident and have not been fairly compensated for injuries to yourself or your passengers, or for damage to your vehicle, you can bring a West Virginia injury lawsuit against the at-fault party if all other attempts at negotiating a settlement have failed. Your chances of success will be much greater if you have the knowledgeable West Virginia injury lawyers at Kaufman & McPherson, PLLC working on your side. We can also help you in your negotiations with your own insurance company, if necessary.

Taking legal action

Another option if you’ve been involved in a crash with an uninsured driver is to file a lawsuit against the at-fault party. This comes with some risk, as even if your claim is successful and a court awards you a settlement, the negligent party may not be able to pay you. In general, uninsured or underinsured drivers tend not to have significant assets or money, which may be why they were unable to afford proper insurance coverage in the first place.

Immediately after an accident with an uninsured or underinsured motorist, contact your own auto insurance carrier to determine your options. If you need further legal guidance, contact a WV attorney at Kaufman & McPherson, PLLC today.